Similar Posts

How Much is Enough??

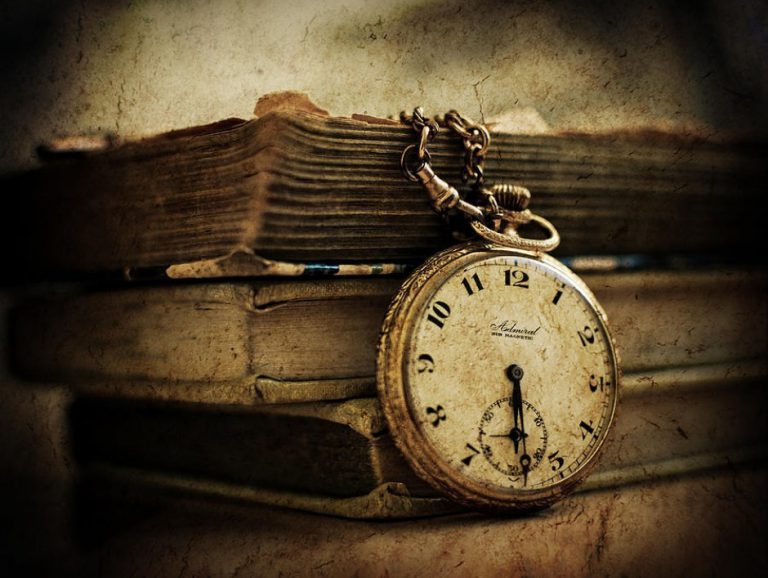

What figure do you have in mind when it comes to your retirement nest egg ? Anyone close to retirement will have these thoughts. Perhaps it would have been more prudent if they had thought about these matters much longer ago. However, we cannot turn the clock back, so the question remains, “how much is…

FINANCIAL WEEK IN A GLANCE

April was a tough month for markets, as they struggled to digest the toxic mix of still-rising inflation and lower growth, along with a helping of weak company results. Having bounced in March, equity markets fell back again as optimism for a relatively swift resolution to the Ukraine conflict dwindled. As of last week, the…

FINANCIAL WEEK IN A GLANCE: KEY TRENDS

A stock bounce reversed in Asia on Wednesday, commodities sank and the Dollar climbed amid ever-louder warnings that Federal Reserve monetary tightening may lead to an economic downturn. An Asia-Pacific share Index shed over 1%, with Chinese technology equities among the worst performers. US and European futures declined as brief optimism from a Tuesday jump in…

May Will Create Defining Legacy After Winning Her Brexit Battle

In November 2016 Britain’s High Court ruled that British Prime Minister Theresa May needed the backing of Parliament to trigger Article 50, a landmark ruling which fuelled speculation that Brexit may be thwarted by pro-EU politicians. Three months on and May has not only secured Parliamentary backing with ease, but has also strengthened her position…

More than 90,000 Royal Mail Told their Final-Salary Pension is ‘Unaffordable’ and may close

More than 90,000 Royal Mail staff have been warned that their final salary pension is “unaffordable” and could be shut down, as experts warn a raft of other private companies will follow suit. Royal Mail has written to employees telling them their “gold-plated” pension scheme may be closed because a deterioration in financial market conditions means…

Time in not Timing

For century’s people have debated what asset class is best in the long term. You can imagine Genghis Khan wondering whether he would be better off with vast swathes of land, or herds of cattle, which one would bring the best rewards in the long term? Each asset class will have good times and bad…